Should you do your taxes on your smartphone or tablet?

pcess609/Getty

Tax season in the United States is still a few days away — you can file taxes starting Jan. 24, 2022 — but until then, you can begin getting ready. That includes finding last year’s forms, collecting necessary forms (W-2, 1099 and 1098) for the current tax year, rounding up your receipts — and choosing a tax form app?

If you’re considering filing your own taxes on your iPhone or Android this year, there are a few things you should know, both good and bad. In this guide, we’ll show you what you need to know before filing a return on your smartphone or tablet. And if you do plan on going mobile this year, we’ll take a closer look at three tax apps that can do the job.

You can start taxes on one device and pick it up on another.

Scott Stein/CNET

Why should I do my taxes on my smartphone or tablet?

You might not be keen on doing taxes on your smartphone because it may seem difficult and tedious, but there are many reasons why it might be a great idea for you:

It’s convenient. Not everyone has access to a computer, but most people own a smartphone — whether it’s an Android or iOS device. The most popular tax apps are available on both the Play Store (Google) and the App Store (Apple), so filing taxes on your mobile device, especially a tablet, is incredibly convenient if you don’t have a laptop or desktop.

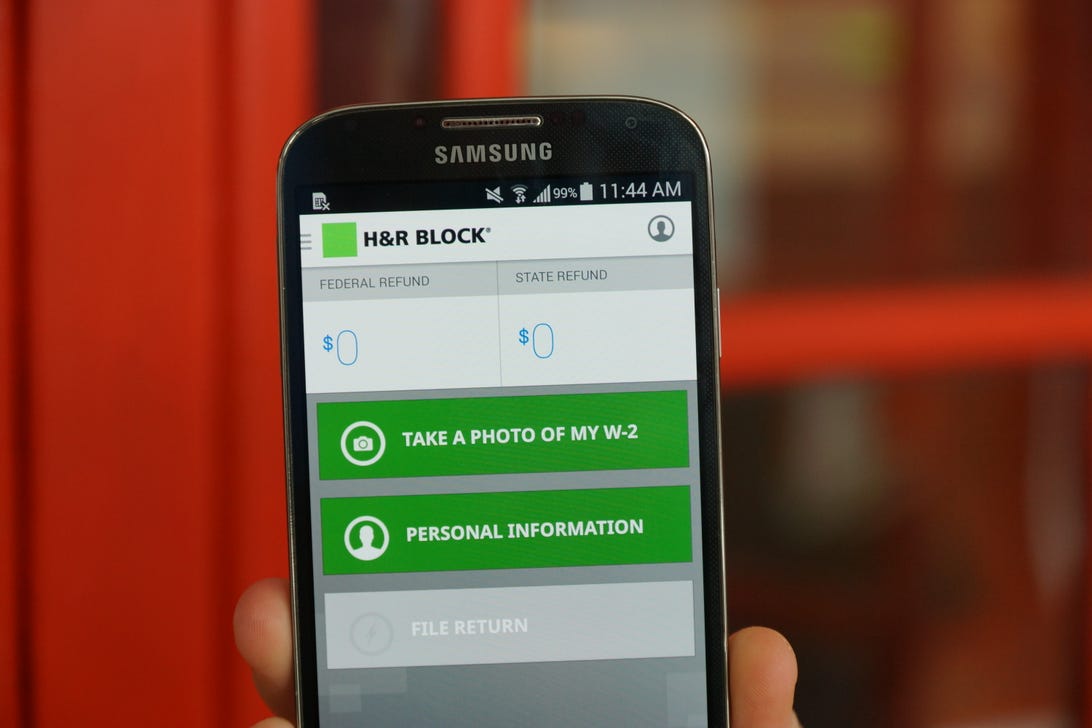

It could be quicker. If you’ve used a tax app before, using it again can make the filing process quicker thanks to information previously saved. And if you take advantage of mobile features, such as document scanning with your camera, you could potentially fill out your taxes quicker on a phone or tablet than you would on a computer.

Live support is available on-camera. If you have trouble with filling out any of the tax forms via app, you might have the option to do a video call with a tax specialist (like an accountant or attorney) to get personalized advice. And if you’re worried about them seeing your information — they can’t. They don’t have access to your personal information unless you provide it to them.

Scammers and hackers could take advantage of you doing your taxes on your mobile device.

Queenie Wong/CNET

What’s bad about doing my taxes on a mobile device?

As with everything, there’s the other side of the coin, which isn’t necessarily terrible but does show the negative side of doing taxes on your mobile device.

It could be a major security issue. Most of these tax apps have a built-in feature that lets you scan your physical W-2 or other tax papers with your smartphone camera, to automatically import your information like your Social Security number, address and phone number. Unfortunately, this may save a photo in your camera roll, which is bad news if you forget to delete it and your phone is then lost or stolen. If anyone has access to your device, they could easily find photos with all your precious information, and use them for malicious purposes.

It might be difficult to do, especially if your taxes are complicated. Did you invest in cryptocurrency this year? Did you buy a house? Do you own a business? If you answered yes to any of these questions, filing your taxes on your phone or tablet might not be the best idea, because working on your phone might get unwieldy when taxes get more complicated.

Features that are available on the computer might not be accessible on mobile. Many times, when computer software is ported over to mobile, certain functions and settings get lost. It could be something as simple as a file size limit for uploads, which might make it more difficult to upload files to the tax app via your phone. Whatever it is, these missing features can make it more difficult to do your taxes on mobile.

If you do choose to go mobile for your taxes this year, here are some of the best tax apps out there

TurboTax. TurboTax by Intuit is one of the most popular tax apps available on mobile devices. If you’ve used the online version on your computer, then the application is pretty much the same thing. To start, you’ll be asked to answer several questions so that TurboTax has a better understanding of what your tax return will look like (dependents, deductions, credits and so on). Once that’s finished, you can begin the free process of e-filing (you’ll need to pay for more complicated returns) using any number of features — document scanning, video calls with tax professionals, multi-device integration, previous year data transfer and more — to make it all as seamless as possible.

H&R Block. The H&R Block Tax File and Prep app provides many of the same features as the other apps on this list. You scan documents with your camera, reach out for help from tax experts, use multiple devices to finish e-filing, and enable security features such as two-factor authentication and Face ID/Touch ID sign-in options. Once you’re ready to file, you can have a tax pro do a thorough review of your return and file it on your behalf, or do it yourself. You can file for free if you have a simple tax return, but there are also paid options for more complex taxes (you pay only when you’re ready to file).

TaxSlayer. TaxSlayer isn’t a household name like the other two tax apps on this list, but there is one major reason to look into using it for e-filing on your smartphone this year — the cost. Although it lacks some of the features that its competitors have, like scanning documents with your camera or receiving mid-year tax check-ins, TaxSlayer offers good prices for more complicated tax returns that involve self-employment, investments, rental properties and more.

Taxes are due pretty soon, which is why we’ve got you covered. Check out how to scan important tax documents with your phone or tablet and the best tax software for 2022: TurboTax, H&R Block, Jackson Hewitt and others compared.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.