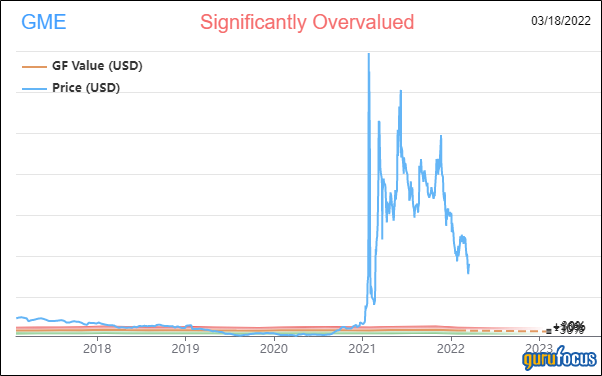

The price action of video game retailer GameStop Corp. (NYSE:GME) over the past two years has been one of the most fascinating stories in stock market history. As a secularly challenged retailer, no one could have predicted it would become a highly volatile trading stock driven by young, day-trading amateurs in their homes. Today the stock still sits at a price well above its fair value.

The company operates physical stores and e-commerce websites around the world with a focus on video games, entertainment products and technology items. GameStop also operates 50 pop culture-themed stores selling collectibles, apparel, gadgets, electronics, toys and other retail products for technology enthusiasts in international markets under the Zing Pop Culture brand. In addition, the company publishes Game Informer magazine, the world’s leading print and digital gaming publication.

As of Jan. 29, GameStop had a total of 4,573 stores across all segments, which include 3,018 in the U.S., 231 in Canada, 417 in Australia and 907 in Europe. The stores and e-commerce sites operate primarily under the brands GameStop, EB Games and Micromania.

2021 results

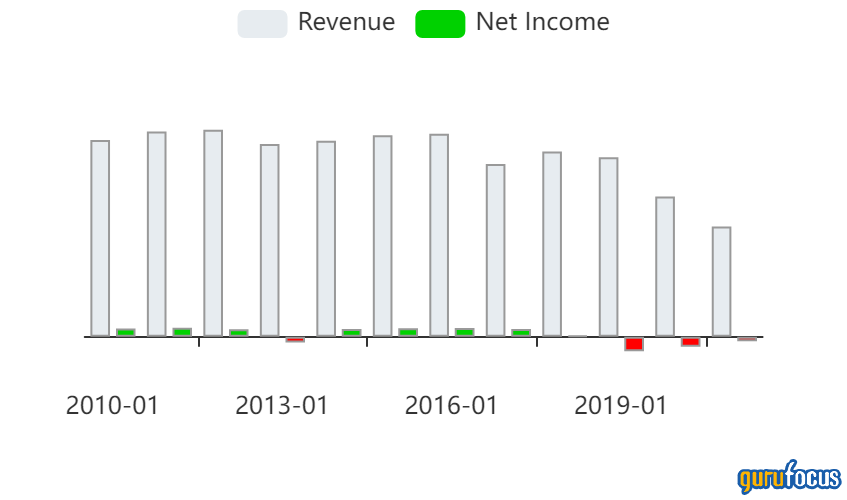

The company recently reported financial results for the fiscal year ending January 2022. Sales increased 18.1% to $6 billion, partially due to expanding the product catalog to include a broader set of consumer electronics, PC gaming equipment and refurbished hardware.

But thats about where the good news ends. Gross margins decreased to 22.4% for the year, down from 24.7% in the prior year. The company reported an operating loss of $368.5 million, largely due to heavy investments in its workforce and technology as it continues its transformation into an e-commerce and digital-centric company.

In the fourth quarter, supply chain and logistics issues, as well as effects from the Covid-19 pandemic, slowed sales of Xbox and Playstation consoles.

However, for the year, strong sales were driven by hardware and accessories, which increased 25% year over year, as well as collectibles, which increased 42%. Software (video games) was the slowest-growing segment, increasing only 2%.

The other good news is that GameStop was able to take advantage of the irrational trading in its stock during 2021, raising equity capital in the amount of $1.67 billion. The company was able to reduce all outstanding debt, so it is now essentially debt free (with the exception of a small $44 million French government loan related to the Covid-19 pandemic).

NFT business

Over the past 12 months, the company has been building out a new dedicated blockchain team to help it capitalize on non-fungible token trading. The company estimates that this could be a $40 billion market at some point. In February 2022, GameStop announce a partnership with Immutable X, an NFT marketplace that is expected to launch by the end of the second quarter. Using blockchain technology to record transactions and ownership, digital currencies and NFTs will be used to purchase in-game virtual items.

This is a core component of the companys turnaround plan, but its still yet to be seen if NFTs will be a real, large-scale marketplace or digital concept. It may just be another bubble market fad that fades away as digital rights technology and increased regulatory scrutiny develop over time.

Valuation

Its certainly hard to value a company when you dont really know what the business model is going to be in the future. Based on current earnings and next year’s projections, the stock is, of course, not worth where its trading today.

Using a discounted cash flow model that assumes profitability and free cash flow occurs within the next two to three years and grows by double digits from that point the stock’s worth probably lies in the $20 to $25 range.

Back in the day, GameStop used to earn 6% operating margins. Applying that to today’s level of revenue would produce earnings per share in the $3 to $4 range. The likelihood of that happening over the next five years, however, is slim to none as the company invests heavily in new digital businesses.

Fortunately, most sell-side analysts have given up and wouldnt touch it with a 10-foot pole. Or at least with a buy recommendation. Well-regarded and insightful analyst Michael Pachter at Wedbush Securities lowered his target price to $30 after the company released 2021 results.

Guru trades

As might be expected, there are no gurus who have purchased or added to GameStop positions in the last six months. It is highly unlikely that any experienced and respected institutional portfolio manager would buy this bubble stock at these price levels.

Conclusion

GameStop’s stock is substantially overvalued at current trading levels based on any reasonable assessment of business value. There have been many successful miracle turnarounds in U.S. corporate history, but to base your investment premise on a hope and a prayer does not seem prudent at this time.

This article first appeared on GuruFocus.